Precore Gold Granted Option to Acquire Arikepay Porphyry Gold-Copper Property in Peru

/EIN News/ -- VANCOUVER, British Columbia, April 23, 2025 (GLOBE NEWSWIRE) -- Precore Gold Corp. (CSE: PRCG) (the “Company” or “Precore Gold”) is pleased to announce that it has entered into a Definitive Option Agreement (the “Option Agreement”) with Alta Copper Corp. (the “Vendor”) to acquire up to a 100% interest in the Arikepay gold-copper property (the “Arikepay Property”) located in the province of Arequipa, Peru (the “Transaction”). The Arikepay Property is located about 110 km south of the city of Arequipa in southern Peru and about 45 km south of the important Cerro Verde Cu-Mo porphyry deposit, one of Peru’s largest mines with over 3 billion tonnes of ore, owned by Freeport-McMoran, SMM Cerro Verde Netherlands and Buenaventura.

Figure 1. Map of Arikepay location among major deposits in Southern Peru

The Arikepay Property is located 40 km from the Pacific Ocean in the coastal region of the Arequipa department in southern Peru. It covers an area of 1,800 ha at an average elevation of 1,200 m above sea level. The property is located within one of the most active mining regions of Peru.

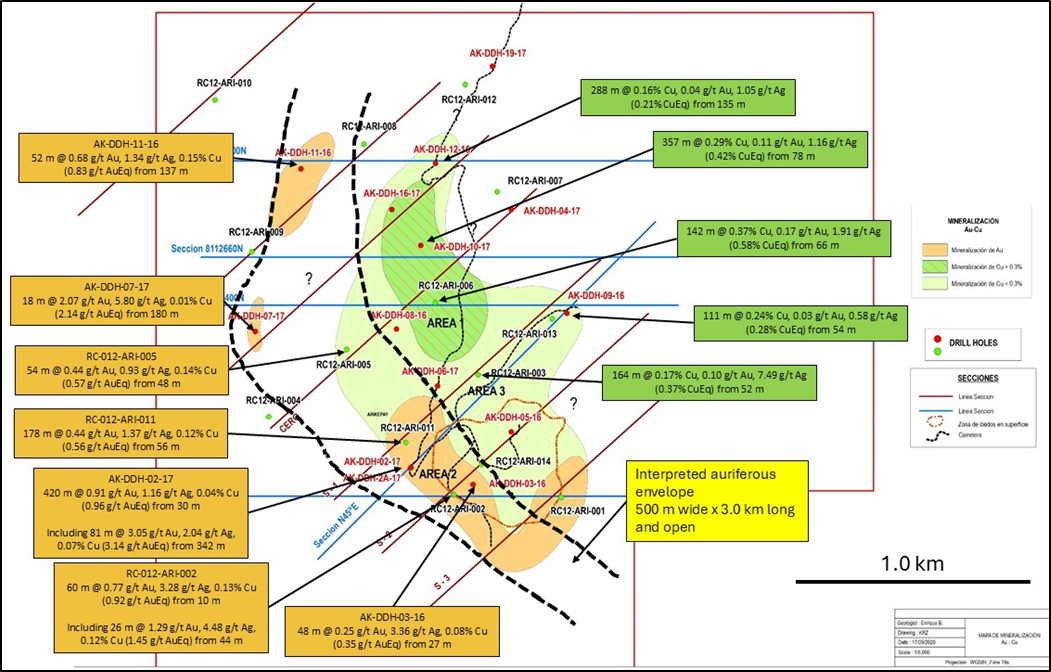

Geologically, the Arikepay Property hosts a multiphased mineralized intrusive complex controlled by NW-SE faults parallel to the Incapuquio fault system and pertaining to the Cretaceous porphyry belt of southern Peru. A Cu-Au-Ag stockwork system was emplaced in a quartz feldspar porphyry and a Au-Ag-Cu event is hosted in a diorite porphyry. The multiphased complex has been recognized over an area of 2 km x 2 km and remains open laterally in all directions and at depth. A total of 13,738 meters of drilling in 32 drill holes have been completed between 2002 and 2017. Phelps Dodge drilled 4 diamond drill holes totaling 1,200 m in 2002. Cobriza Metals Peru drilled 14 reverse circulation drill holes totaling 3,630 m in 2012 and Compania Minera Zahena (“Zahena”) drilled 14 diamond drill holes totaling 8,908 m in 2016-17.

Best historical drill intercepts in the Cu-Au-Ag quartz-feldspar porphyry include*:

- 142 m @ 0.37% Cu, 0.17 g/t Au, 2.02 g/t Ag (0.65% CuEq1) from 66 m in hole RC-012-ARI-006

- 357 m @ 0.29% Cu, 0.11 g/t Au, 1.16 g/t Ag (0.47% CuEq1) from 78 m in hole AK-DDH-10-17

- 111 m @ 0.24% Cu, 0.03 g/t Au, 0.58 g/t Ag (0.29% CuEq1) from 54 m in hole AK-DDH-09-16

Best historical drill intercepts in the Au-Ag-Cu diorite porphyry include*:

- 420 m @0.91 g/t Au, 1.16 g/t Ag, 0.04% Cu (0.96 g/t AuEq2) from 30 m in hole AK-DDH-02-17

- including 81 m @ 3.17 g/t Au, 2.12 g/t Ag, 0.07% Cu (3.26 g/t AuEq2) from 342 m

- 66 m @ 1.23 g/t Au, 0.36 g/t Ag, 0.03% Cu (1.26 g/t AuEq2) from 27 m in hole AK-DDH-02A-17

- 60 m @ 0.77 g/t Au, 3.28 g/t Ag, 0.14% Cu (0.93 g/t AuEq2) from 10 m in hole RC-012-ARI-002

- including 26 m @ 1.29 g/t Au, 4.48 g/t Ag, 0.12% Cu (1.45 g/t AuEq2) from 44 m

- including 26 m @ 1.29 g/t Au, 4.48 g/t Ag, 0.12% Cu (1.45 g/t AuEq2) from 44 m

To date there has been no follow up on the significant gold intercept in hole AK-DDH-02-17 and it constitutes the priority target for the inaugural drilling program that Precore Gold is currently planning.

*CuEq and AuEq were calculated using the following metal prices: Au = US$3,000/oz, Cu = US$4/lb, Ag = US$32/oz

Copper equivalent formula:

1CuEq = Cu + 1.458379*Au + 0.015556*Ag (no use of Pb, Zn or Mo and recoveries were assumed to be 100%).

2Gold equivalent formula: AuEq = Au + 0.914257*Cu + 0.010666*Ag (no use of Pb, Zn or Mo and recoveries were assumed to be 100%)

Figure 2. Regional geology and major deposits in southern Peru

Figure 3. Map including best historical drill intercepts at Arikepay (Source: Enrique Bernuy 2020)

Paul Dumas, Executive Chairman of Precore Gold, comments, “We are extremely pleased for this opportunity to option the Arikepay Project, which we believe contains exciting discovery potential. Its location in Peru, one of the most prolific mining jurisdictions and one of the world’s top mineral producing countries, makes it an attractive hub for global stakeholders. Alta Copper has been laser focused on advancing their flagship project, Cañariaco, that has an initial CapEx of US$2.1B and an NPV of approximately US$2.4B as per their 2024 PEA. As a result, no exploration work has been conducted at Arikepay since 2017. We noticed, after having evaluated the project’s historical data, that the gold and copper equivalents constitute what would be fantastic grades in an open-pit scenario. We plan to initiate an exploration program in the near-future, which would follow-up on the impressive results mentioned above, obtained from the last exploration campaign in 2017.”

Mining and Mineral Exploration in Peru

Peru, long considered an important producing country in the global mining sector, is noted especially for its copper, gold, zinc and silver resources. The country has 10.2% of the world's copper reserves, 3.9% of the world’s gold reserves and 21.8% of the world’s silver reserves, as well as reserves of other significant metals, according to the most recent data published by the US Geological Survey. According to estimates, Peru’s metals and mining sector accounts for 8.5% of Peru’s GDP, while mineral exports from the country represent about 63.9% of its total exports. In 2024, Peru's mining exports reached a record US$47.7 billion, representing a 11.5% increase compared to 2023 (America Economica, February 2025). Over the last several decades, many global mining companies, such as Newmont, Barrick and Free-McMoRan, have operated Tier-1 projects in Peru. The country enjoys political stability, an investor-friendly regulatory framework, and a commitment to sustainable mining practices. With 51 projects in different stages of development, this represents a US$54.6 billion investment pipeline with a US$644 million exploration budget for 2025 (US Geological Survey 2025, Reuters).

Transaction details:

The Company has entered into the Option Agreement to acquire up to a 100% interest in the Arikepay Property. Pursuant to the Option Agreement, the Company may earn an initial 51% interest in the Arikepay Property (the “First Interest”) by:

- Issuing to the Vendor 1,500,000 common shares in the authorized share structure of the Company (the “Initial Shares”) upon receiving Canadian Securities Exchange approval to the Option Agreement;

- Issuing to the Vendor an additional 1,000,000 common shares within 4 months after the date of issuance of the initial shares; and

- Incurring a minimum of Cdn$5,500,000 in expenditures in relation to the Property within the next 5-year period, with Cdn$1,500,000 to be incurred within the first three years; and

The Company can earn an additional 24% interest in the Arikepay Property (the “Second Interest”) (for an aggregate 75% interest) by:

- Issuing to the Vendor an additional 1,000,000 common shares;

- Incurring additional minimum expenditures of Cdn$3,500,000 in relation to the Property; and

- Making annual cash payments to the Vendor of Cdn$75,000 during each of the five years following the fifth anniversary date of the Option Agreement, for total cash payments of Cdn$375,000.

The Company may acquire an additional 5% interest in the Arikepay Property (the “Third Interest”) (for an aggregate 80% interest) by having identified an inferred mineral resource estimate on the Arikepay Property and caused to be prepared a technical report in respect of such resource estimate.

Finally, the Company may acquire the remaining 20% interest in the Arikepay Property (for an aggregate 100% interest) by paying to the Vendor an additional Cdn$1,000,000 (or issuing the equivalent value in common shares of the Company) and granting a 1.5% net smelter return royalty in respect of the Arikepay Property.

Milestone Payments:

Under the Option Agreement, Precore Gold is obliged to make the following milestone payments to the Vendor:

- Upon Precore Gold having identified an inferred mineral resource estimate of 1M oz AuEq on the Arikepay Property - Cdn$1,000,000 in cash or the equivalent value in common shares of Precore Gold;

- Upon Precore Gold having identified an inferred mineral resource estimate of 2M oz AuEq on the Arikepay Property - an additional Cdn$1,000,000 in cash or the equivalent value in common shares of Precore Gold;

- Upon Precore Gold having prepared or caused to be prepared a preliminary economic assessment in relation to the Arikepay Property - an additional Cdn$2,000,000 in cash or the equivalent value in common shares of Precore Gold; and

- Upon Precore Gold having prepared or caused to be prepared a feasibility study in relation to the Arikepay Property - an additional Cdn$3,000,000 in cash or the equivalent value in common shares of Precore Gold.

Operator and Joint Venture Agreement:

If after Precore Gold has earned the First Interest, Second Interest or Third interest and Precore Gold has waived or abandoned its right to acquire any future interest in the Arikepay Property, the parties shall enter into a joint venture agreement (the “JV Agreement”) for the Arikepay Property that would contain market standard joint venture terms.

During the term of the Option Agreement, Precore Gold shall be the operator of the Arikepay Property and shall have the final approval authority for exploration and development programs and expenditure budgets.

The Transaction remains subject to the approval of the CSE Exchange. Any common shares of the Company issued to the Vendor pursuant to the Option Agreement will be subject to a statutory four month and one day hold period commencing on the date of issuance of such shares.

A finder’s fee of 500,000 common shares of the Company is to be paid to an arm’s length finder.

Information on historical assay results

Zahena diamond drilling was conducted on HQ and NQ sizes by Geodrill SAC. The 3 meters samples were prepared at ALS lab in Arequipa city applying the following protocol: crushing 70% passing 2mm, pulverization 85% passing 75 microns to produce a 250 g sample. The assays were conducted at ALS lab in Lima city using the following protocol: Au obtained by ICP analysis and overlimits by gravimetry + 35 elements by ICP with overlimits for Ag, As, Co, Cu, Mo, Ni, Zn and Pb reassayed by atomic absorption. A total of 9 control samples (blank, standard, pulp duplicate, reject duplicate and core duplicate) were inserted within 66 samples for a total of 75 samples per batch. (Source: Informe Final de Exploracion y Evaluacion Geologica Proyecto Arikepay por Felipe Cadenas y Jorge Cabrera, Abril 2017)

Cobriza’s program was conducted using a reverse circulation drill rig. Samples were taken every 2 meters for an average weight of 5 kg. The samples were assayed by SGS lab in Lima Peru. The 250-gram split was pulverized to -140 mesh. Gold was analyzed by fire assay with an atomic absorption finish, and silver, copper, and molybdenum values were assayed by ICP. A blank, standard, or duplicate sample is inserted into each batch every 25 meters. (source: Informe del prospecto Arikepay porfido cobre oro plata por O. Ramos, Julio 2012).

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Mr. Louis Gariépy, P.Eng (OIQ #107538), Lead Technical Advisor of Precore Gold, who is a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Precore Gold Corp.

Precore Gold Corp. is a Canadian junior gold exploration company focused on building a solid portfolio of exploration projects with strong gold discovery potential, in order to capture the strength of the gold market and to generate shareholder returns. The Company plans to seize opportunities, whereby promising properties are located in prolific mining camps, may contain important historical drilling results and are located in politically stable, Tier-1, mining friendly jurisdictions. Precore Gold’s mission is supported by diligent environmental, social and corporate governance (“ESG”) standards.

For shareholder inquiries, please contact:

Paul Dumas, Executive Chairman

Email: precoregoldcorp@gmail.com

Tel: 514-994-1069

Forward-looking statements

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, future geological work or exploration programs, the potential positive exploration results, the timing of the exploration results, the ability of the Company to finance exploration programs and the potential mineralization or potential mineral resources are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have', "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to meet expected, estimated or planned exploration expenditures, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cd887c08-46c5-4940-982a-4f202c0f6553

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ea326a9-0223-490b-a034-edf3591dd174

https://www.globenewswire.com/NewsRoom/AttachmentNg/fafbff53-d2aa-477c-8bba-43cc14f6644b

Distribution channels: Companies, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release